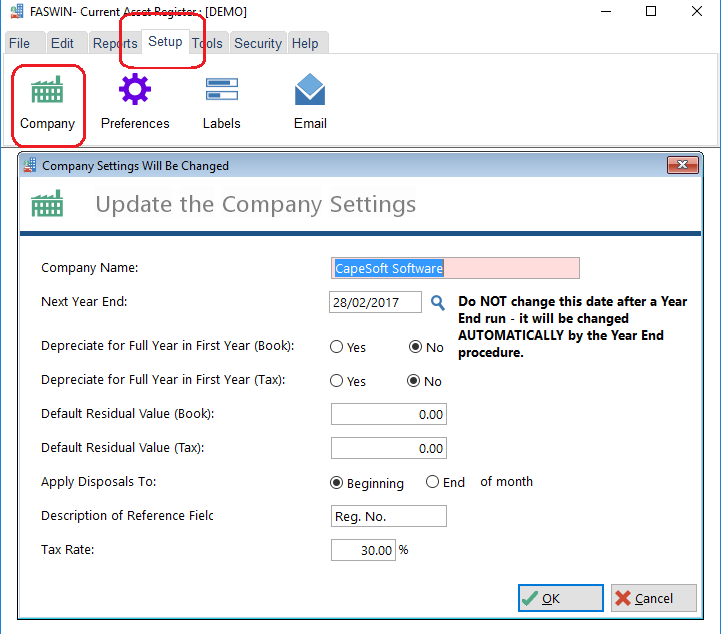

To open the Company Settings Form go to the Setup menu and then to the Company option.

The name of the company as it will appear on reports.

The next financial year end for the company. This field is in dd/mm/yyyy format.

If assets are acquired during the year, you can choose to either depreciate them for a "whole year" in that year, or only depreciate it on a pro-rata basis based on the length of time the asset has been owned. If you wish to depreciate on a pro-rata basis then set this to No.

Usually you will set this to be the same as the item above it, however if the requirements of your Tax collector are different then you are free to set a different value here.

Most companies depreciate assets to zero. However you may have a different default residual value. If so you can enter it here. This will be used as the default when adding assets, however it can be changed for each asset.

Usually you will set this to be the same as the item above it, however if the requirements of your Tax collector are different then you are free to set a different value here.

If you sell, or scrap, an asset during a month then depreciation may, or may not, be calculated for that month. If you set this to End of Month then the asset will be depreciated for the full month in which it is sold. If it is set to Beginning of Month then it will not be depreciated in the month in which it is sold.

One of the fields which you can capture for each asset is the Reference field. If you would like this field to have a different name then you can enter that name here.

This rate is used by the deferred tax report. Set this number to be your current company tax rate. If you are a non-profit organization, and exempt from tax, then set this to 0.